corporate tax increase proposal

President Biden unveiled a budget proposal this week that includes a new wealth tax targeting the richest Americans and aimed at. Biden had proposed raising the current corporate.

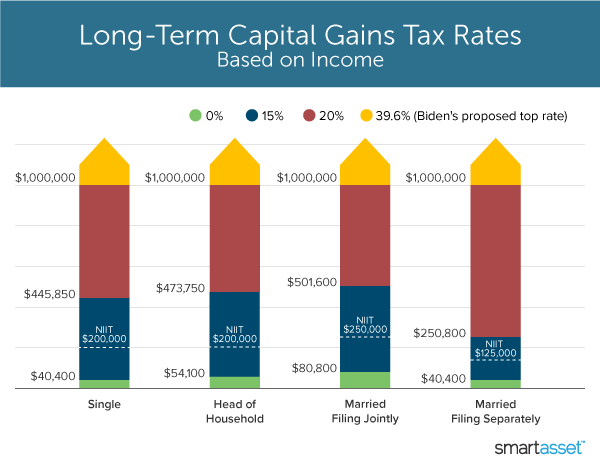

What S In Biden S Capital Gains Tax Plan Smartasset

The proposal sent to Congress touts a reduction in the federal budget deficit of more than 1 trillion over the next 10 years.

. Raise taxes on the foreign earnings of US. The proposal would have an effect on the measurement of the existing deferred tax assets and liabilities that are expected to reverse in FY 2022 and onwards. Bidens plans contain several tax proposals that in total would increase business income taxes by more than 2 trillion over 10 years including.

This is paid for in part by raising the corporate tax rate from 21. For corporations with income 2b. President Bidens tax proposal would.

Increase the minimum corporate tax rate to 21 for all US. Rather than the 21 enjoyed by many businesses from the Tax Cuts Jobs Act of 2017 C corporations would see a new 28 flat tax rate. All of that adds up to 722 billion in tax increase proposals on high-income andor high-wealth individuals.

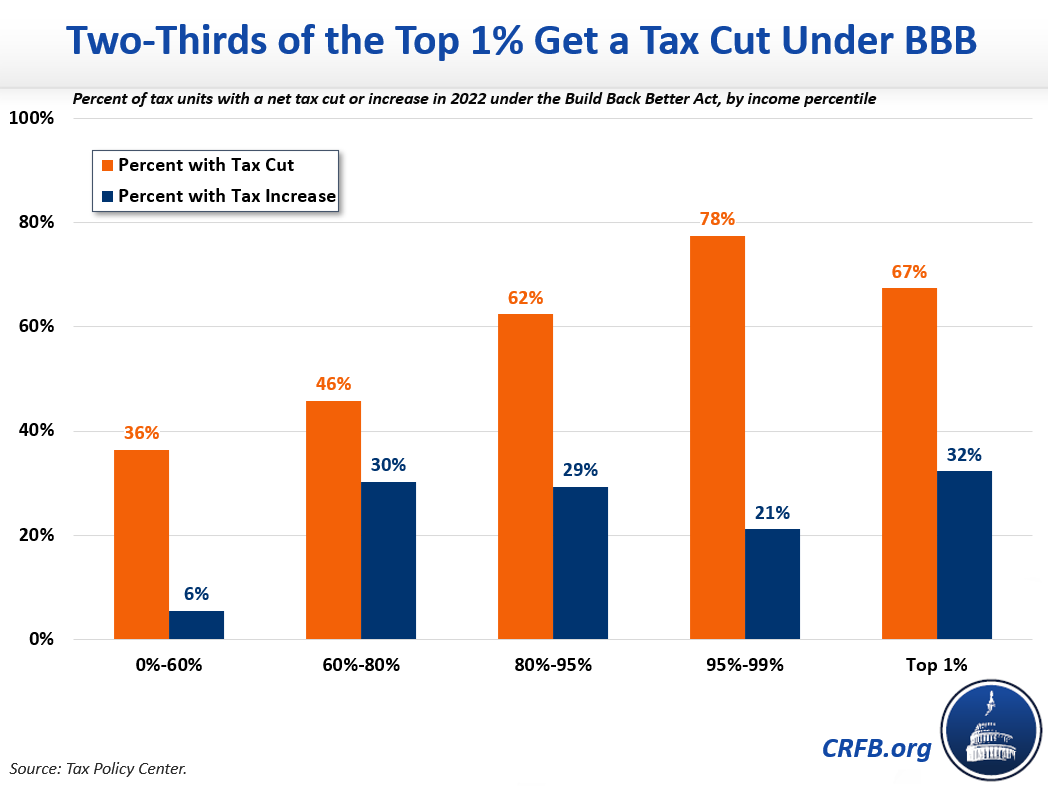

However the administration has also proposed significant tax increases on high-income Americans including a highly questionable proposal to tax the unrealized gains of both liquid and illiquid assets for high-wealth individuals. The Senate Finance Committee draft of the BBBA contains similar provisions. Subtitle I Corporate and International Tax Reforms.

Before the 2017 law the main Republican corporate tax reform proposal was the 2014 plan from then-House Ways and Means Committee Chairman Dave Camp which would have cut the corporate tax rate to 25 percent. 396 top individual rate. However before you make any decisions remember that.

November 16 2021. Currently the federal tax rate on corporations is 21 down from the 35 rate that was in effect prior to the 2017 Republican tax restructuring. The House-passed Build Back Better Act BBBA.

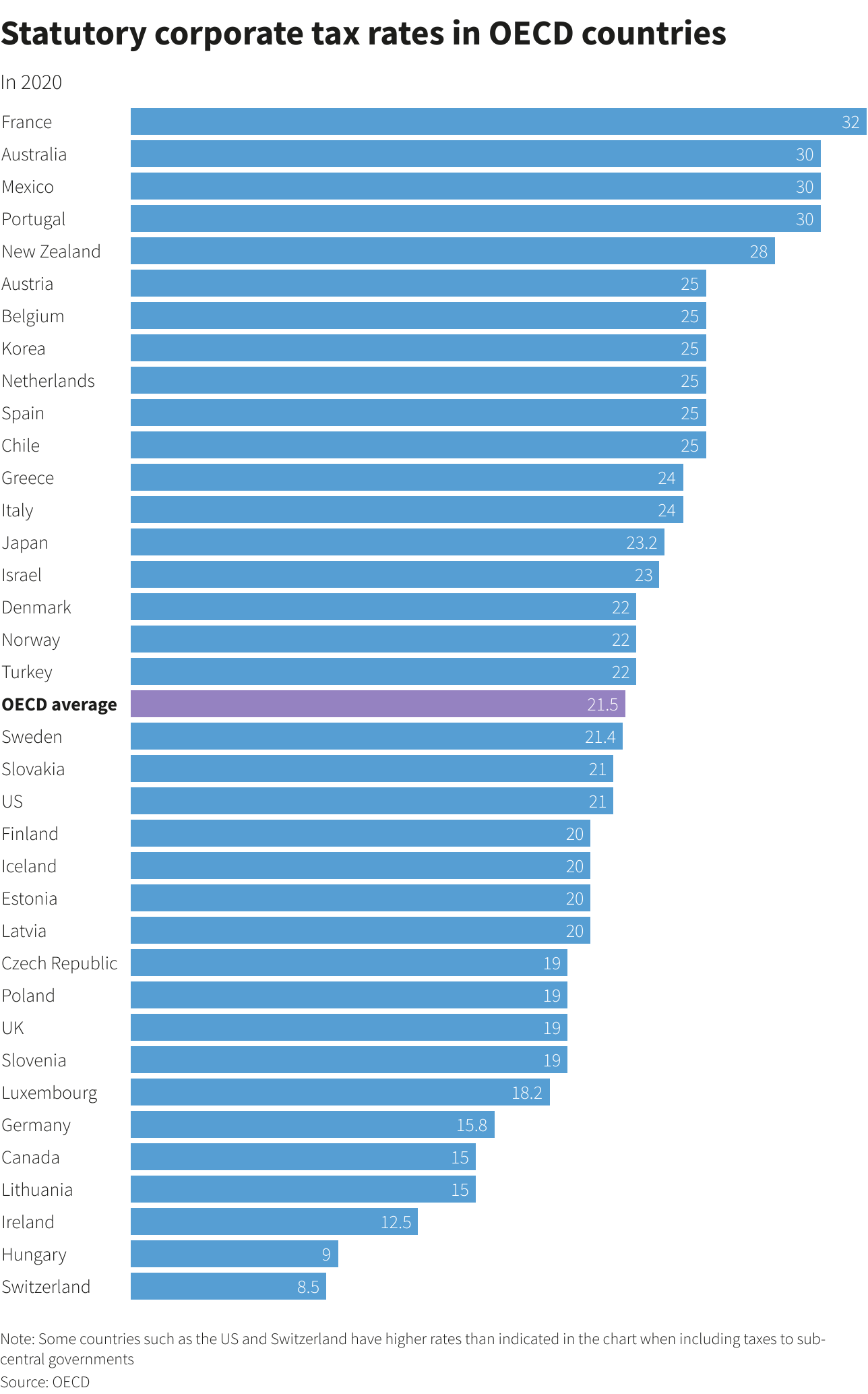

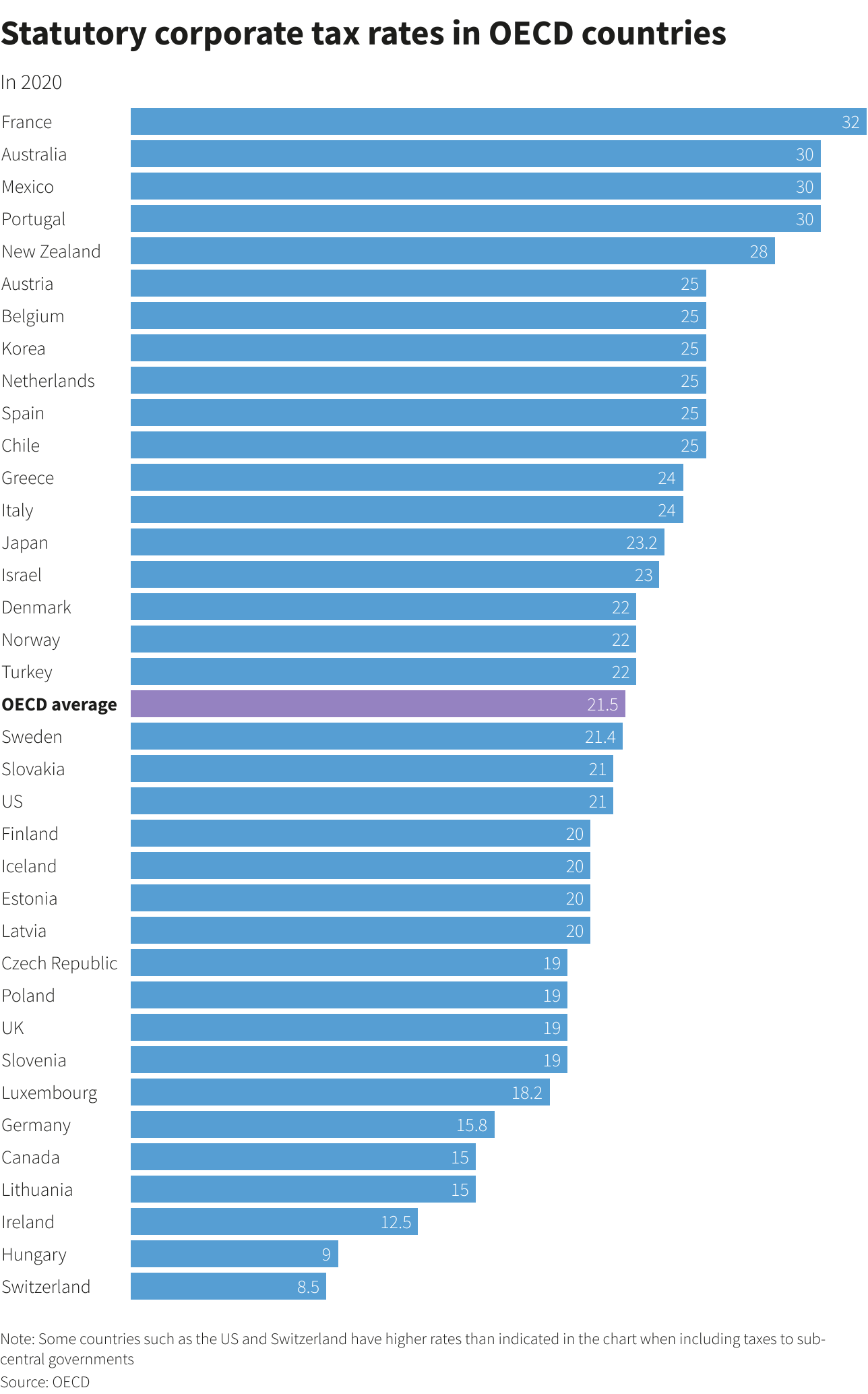

An increase in the federal corporate tax rate to 28 percent would raise the US. 28 corporate rate. Raise the corporate tax rate to 28 percent.

Importantly the Camp plan would have moved away from aggressive accelerated depreciation which lets businesses claim larger upfront deductions for. A 15 minimum tax on the financial statement book profits of corporations that report over 1. The House proposal would take huge steps to reverse the 2017 Republican tax cuts.

Ways and Means Committee Chairman Richard Neal has proposed 25 new tax policies that would on net raise taxes on US. 5376 would raise around 800 billion in corporate taxes in FY2022-FY2031. The effort to revamp the business license tax began in 2020 when Fortunato Bas proposed giving small companies a slight break and raking in more money from the larger ones.

The Presidents budget also re-proposes a 28 corporate income tax rate and numerous other tax provisions that were included in. Increase the corporate tax rate to 28. It would hike the corporate rate to 265 after the GOP slashed it to 21 from 35.

Democrats unveil new plan to increase taxes on billionaires. Federal-state combined tax rate to 3234 percent higher than every country in the OECD the G7 and all our major trade partners and competitors including China. Senate Democrats are proposing new tax increase measures to offset the cost of Build Back Better reconciliation legislation in response to objections from Senator Krysten Sinema D-AZ to increasing the marginal tax rates for corporate individual and capital gains income.

Biden says will raise about 1t and that it will still be much lower than the 35 in 2017. Raising the Corporate Tax Rate The corporate tax rate is currently. New business tax increase proposals include an undertaxed profits rule that would replace the current base erosion anti-abuse tax BEAT.

Proposals would increase corporate taxes in most cases by altering the international tax structure. President Bidens administration has made a proposal to increase the corporate tax rate. For taxable years beginning after January 1 2021 and before January 1 2022 the tax rate would be equal to 21 percent.

How the Proposed Corporate Tax Rate Increase Affects Small Business Owners. New details of a Democratic plan to enact a 15 minimum corporate tax on declared income of large corporations were released Tuesday by three senators. 396 capital gains rate for incomes over 1m.

Superintendent William Caldwell and Business Manager Laura Napoli updated board members on the status of the proposed budget. RIPLEY It appears that residents of the Ripley Central School District will not see an increase in the tax levy for the 2022-23 school year board of education members learned at their recent meeting. Corporate Tax Rate Increase.

Eighty-seven percent of these revenues are raised from 5 major changes to the corporate tax code though the proposal to raise the US. One of these concerns is the potential increase in the top corporate tax rate from 21 to 28. 15 minimum tax based on book income.

Corporations including income from countries that. Increase the corporate tax rate to 28 percent from the current 21 percent rate. Corporations by 9636 billion over the next decade.

Raises about 191b per year according to JCT. Enact a new 15 percent minimum tax on book income for large corporations. There is a lot of concern among small business owners about how Democrats in Congress will pay for their legislative priorities.

The 2022 Tax Plan proposes to increase the headline corporate income tax rate from 25 to 258 for fiscal year FY 2022 and onwards.

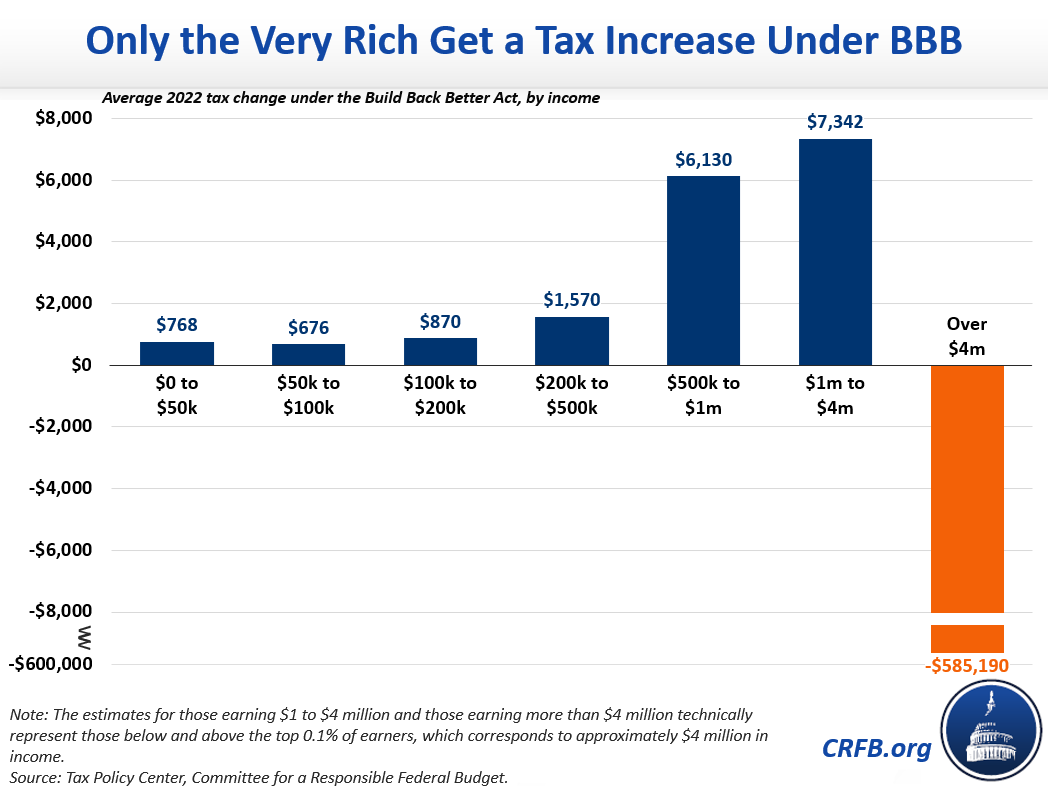

Two Thirds Of The One Percent Get A Tax Cut Under Build Back Better Due To Salt Relief Committee For A Responsible Federal Budget

House Democrats Propose Tax Increases In 3 5 Trillion Budget Bill

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

How A Global Minimum Tax Would Deter Profit Shifting And One Way It Would Not Piie

Us Ceos Think Biden S Corporate Tax Rate Hike Will Have Negative Impact Survey Us Taxation The Guardian

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

Countries Agree With Plan To Set Minimum Corporate Tax Rate World Economic Forum

Corporate Tax Reform In The Wake Of The Pandemic Itep

Individual And Corporate Tax Reform

How Do Taxes Affect The Economy In The Short Run Tax Policy Center

Two Thirds Of Millionaires Get A Tax Cut Under Build Back Better Due To Salt Relief Committee For A Responsible Federal Budget

Tax Cuts And Jobs Act Tcja Taxedu Tax Foundation

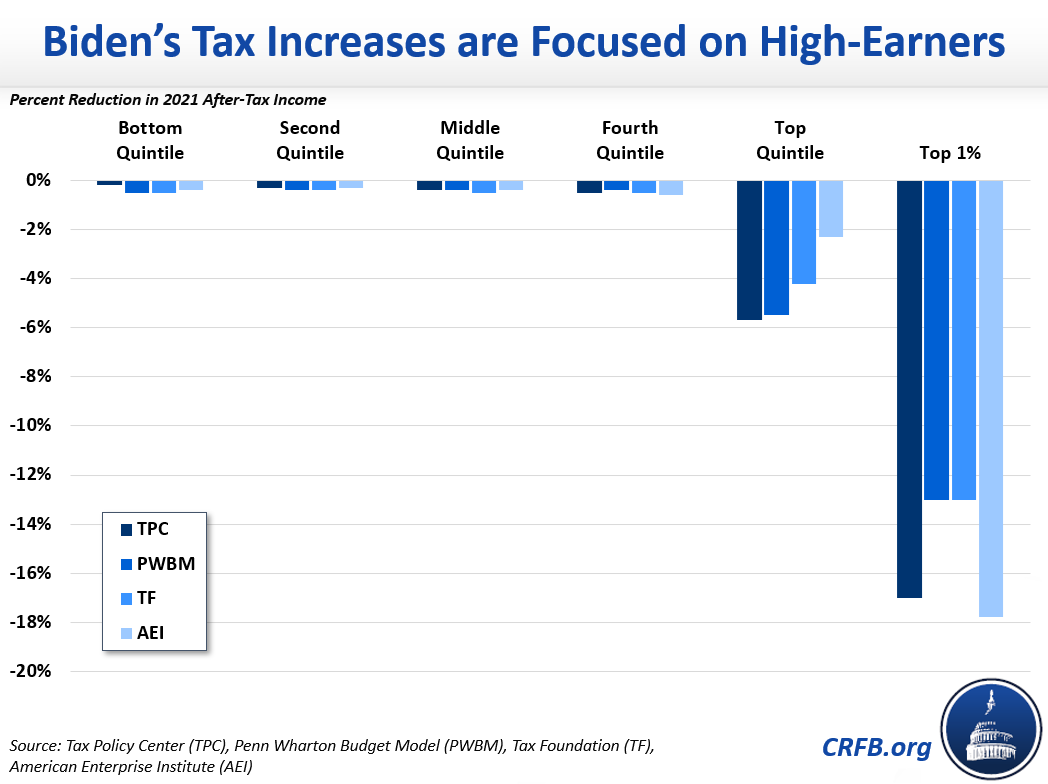

Would Joe Biden Significantly Raise Taxes On Middle Class Americans Committee For A Responsible Federal Budget

Us Offers New Plan In Global Corporate Tax Talks Financial Times

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)